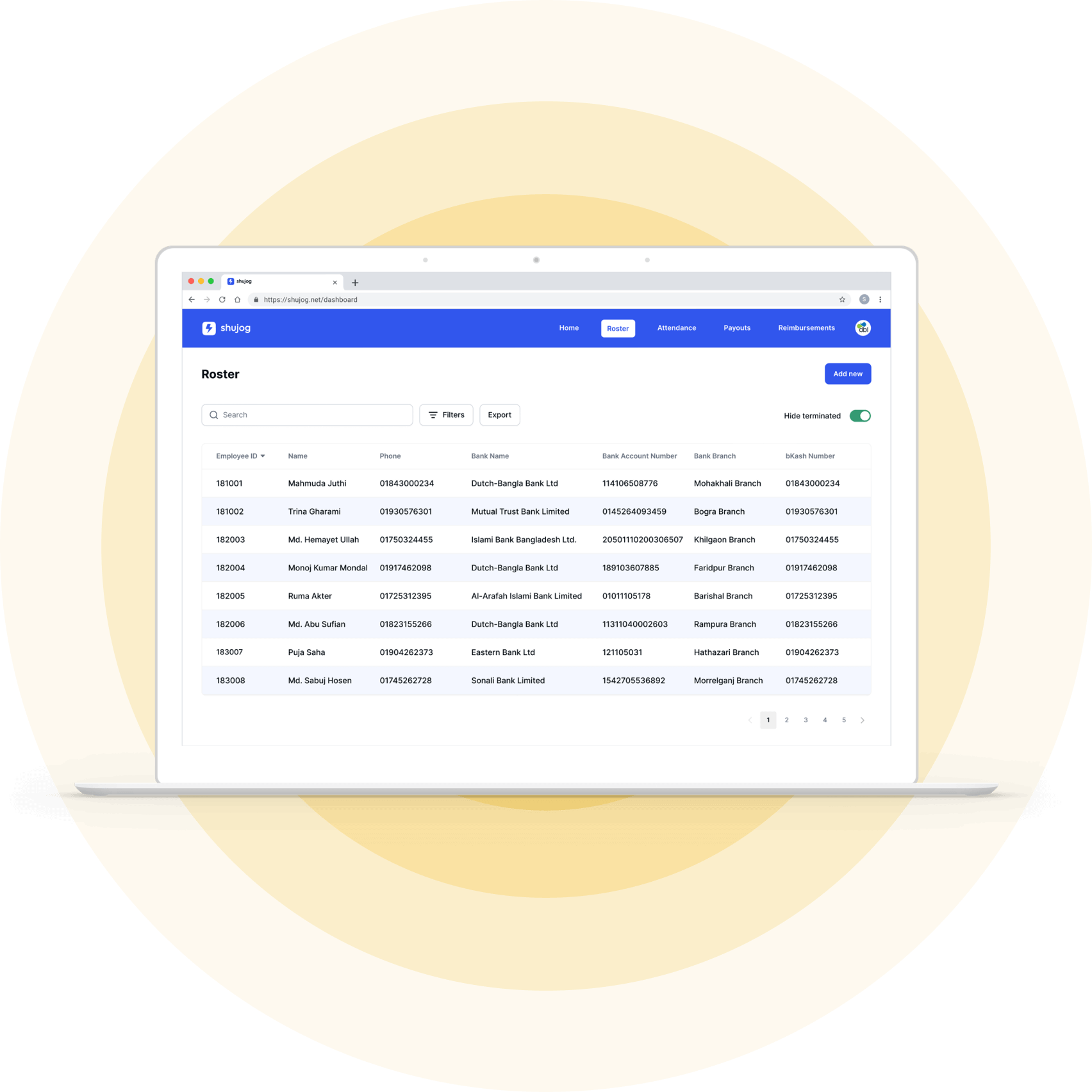

Set your business up on Shujog

We work with your finance and HR teams to connect your roster and attendance systems with Shujog and create a tailored rollout plan.

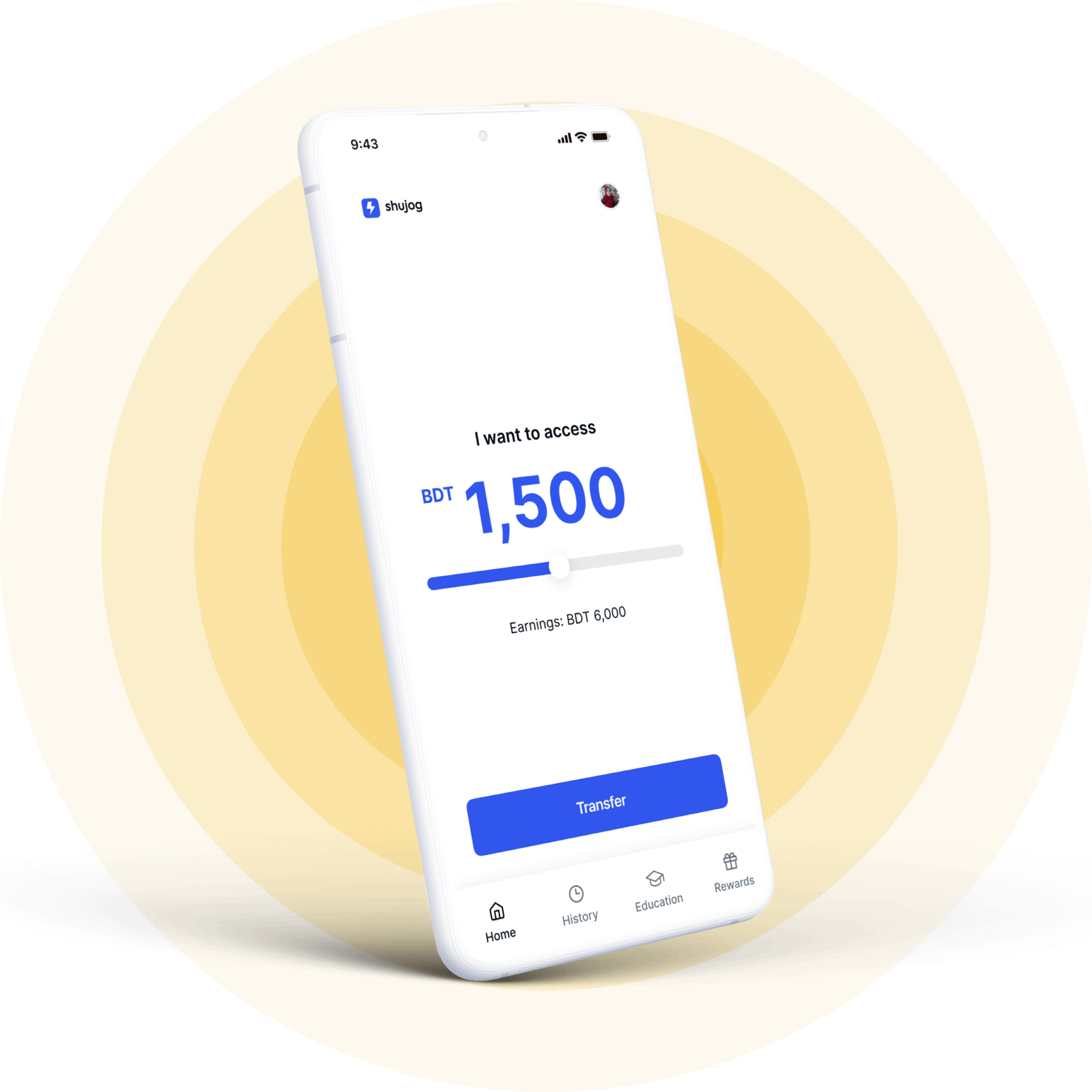

Invite your workforce to Shujog

Employees can use Shujog through USSD, IVR, or apps for the web, Android, or WhatsApp to withdraw up to 50% of their earned wages.

Automate salary advance requests

Withdrawals get deposited to employees’ payroll accounts and are adjusted with their salaries at the end of each pay cycle.

Measurable impact on your business

Giving employees control over their paycheck improves productivity, motivation, and retention, leading to a measurable impact on your bottom line.

Reduced turnover

Allowing your employees to access their earned wages increases morale and job satisfaction.

Increased productivity

Not having to worry about money means your employees can focus

on what is really important for

your business.

on what is really important for

your business.

Higher retention

Offering benefits to boost the

financial health of your

employees creates trust

and improves retention.

financial health of your

employees creates trust

and improves retention.

Your employees will love it

Shujog enables your employees to access part of their already earned wages allowing greater flexibility to pay bills on time, avoid late fees, and pay for unexpected expenses.

Shujog gives your employees instant access to their earned wages when they want it–no need to wait for payday!

Shujog is and will always be free for your employees. This means no more overdraft fees or high interest payments.

We provide your employees with personalized financial advice to help them make smarter decisions about their money.

Our mission

Shujog was founded on the belief that every working person deserves a life free from financial hardship. For low and middle-income workers in Bangladesh and other developing countries, however, this remains something of a pipe dream. We want to change that, starting with giving these workers more control over how and when they get paid. By giving people power over their pay, we protect them from financial shocks, and help break the cycle of

debt caused by late fees and payday loans. This allows people to make better long-term decisions like

investing in healthier food, education, safer housing, and savings, and in the process, lift themselves

and their families out of poverty.

Request demo